When I started working through my financial issues this is exactly how I felt. I had no idea how difficult it was going to be. I thought I would set some financial goals, put some money aside every month, and then some how magically I would just pay off my debts.

Boy was I wrong 🙁

It wasn’t until I really got serious about getting my financial life under control that I realized what a mess I was in.

Trying to save money is super hard…especially since we are more conditioned to spending. And it always feels like there is something that takes precedence. However, out of control spending can be what’s holding you back from achieving your financial goals.

In this article, I want to walk you through the exact steps that I took that changed my life.

You will learn what to prioritize, how to identify where your money is going, get your spending under control, and start saving to pay off your debts. Plus, I will tell you exactly WHY you need to make paying off your debts a top priority.

Ready. Let’s go.

1. Track your expenses and identify your spending habits

If you want your financial life to improve dramatically, take a few minutes each day to track your expenses. According to an article written by Whitney Hansen, Money Coach and host of award-winning podcast “The Money Nerds”, “Simply tracking your expenses every single day will lead to more financial success and results”.1

Simply tracking your expenses every single day will lead to more financial success and results.

Whitney hansen, money coach (the money nerds)

One reason why you need to track your expenses is to become more aware of your spending habits. Keeping a detailed list will help you assess how well you are managing your finances, but more importantly to identify where you are spending your money. Are you overspending? What specifically are you spending your money on? Is it a must-have or something you can do without?

Once you are able to identify patterns in your spending habits it will be easier to remedy a solution. Are you doing well with your grocery budget, but tend to get out of control with clothing and personal items?

Track your expenses for 30 days, review, find the patterns, and make adjustments as needed. Then in month two do it all over again. Rinse repeat. Keep following this until you have a good handle on your weak points. Make sure you have a clear solution to avoid over spending.

Be honest with yourself. Do you really need that new purse or lipstick? Or whatever it was that was tugging you. When you’re aware of your own temptations it becomes easier to find the solution that is right for you. And sometimes the best solution is to just walk away.

When it comes to shopping ‘out of site out of mind’ is my favorite answer. If I don’t know about the latest sales I cannot be tempted. Throw out the advertisements. Get off the mailing list. And stay focused on the big picture.

2. Set a financial goal and commit to it wholeheartedly

I’m a huge believer in goal setting. It’s the only way that I have found that you can quantitatively measure your success. Plus, it’s super motivating when you start seeing results. Just think of losing weight. When you see the scale moving it is proof that what you are doing is working. Well the same is true for saving money.

So if you are serious about wanting financial stability in your life, then setting the right goals will definitely move you in that direction. Set your goals, make them achievable, figure out the actionable steps and commit wholeheartedly.

But how I do that?

The key to effective goal setting is to build systems than can be replicated. They should be simple and easy to follow. Plus, there should be an element of fun to it. And I don’t mean fun as in playful, but rather something that keeps your interest and focus as otherwise it is too easy to slip away.

Here are a few examples you might want to try:

- Complete a challenge – either a 30 or 52 day

- Create a vision board – set it up in a way that you can see the growth (it’s very powerful)

- Write yourself a mock check of the amount you want to save and pin it near your work- station as a daily reminder – great way to stay focused on the end goal

While these suggestions are not direct actionable steps, what they do instead it create an environment for success.

Charlotte Cowles in his recent article revealed a theory from a study that stated, “incorporating emotional attachments into savings goals, and reinforcing those attachments with concrete, visual objects, would make people more likely to reach them than basic financial education alone”.2 Go the extra mile and you will see the fruits of your hard work.

3. Create a budget that works for you

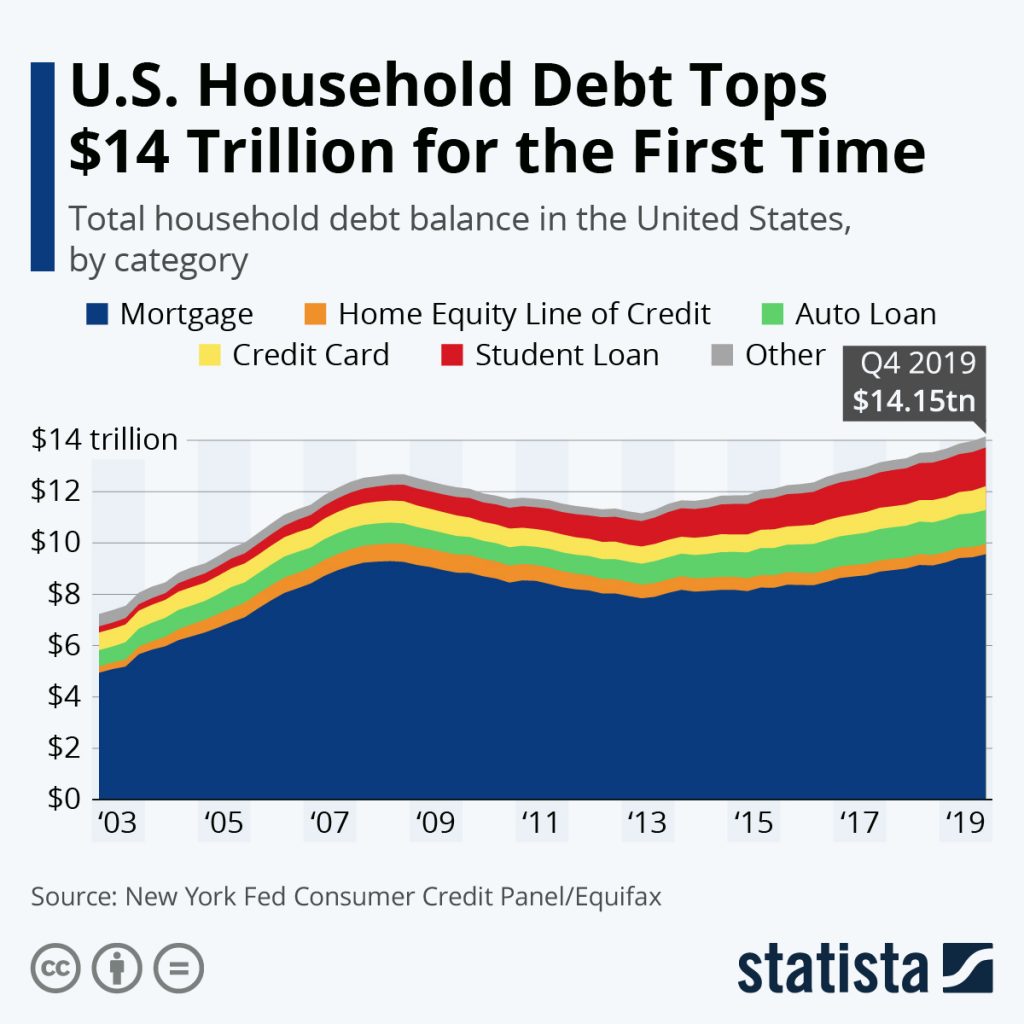

According to Statista, consumer debt in the United States hit an all time high of $14 trillion in the forth quarter of 2019. That number is higher than ever exceeding the previous peak in 2008 by $1.5 trillion.3

People are spending more money than ever. Nowadays, people don’t realize that they’re abusing their credit cards and spending money they don’t have, until they find themselves drowning in debt.4

Whether you have debt or not, creating a budget is the answer to keeping your expenses under control.

By creating a budget, you’re fully aware of how much money is coming in and how much is going out. As well, you can allocate funds to different categories based on need. Once you have accounted for all of your fixed expenses you can see how much is left over. This will help you determine how much you can save, but as well how much can you really afford to spend on those extras.

Decide what you must have. What is it that you need? Write it down. Can you afford it? If not, what are you doing to increase your income so you can afford it?

Your budget will not only help you stay on track with your finances, but as well it will reveal the gaps. Do you need a side hustle to pay off some debt? Do you need to re-adjust where you are spending?

Once you have it all laid out in black and white you can prioritize your needs and adjust accordingly.

Creating a budget is highly individualistic. It is not a one size fits all blueprint. You need to figure out what works for you. Otherwise, it will be very difficult for you to stick to it. Maybe you work better with short timelines like daily or weekly, or you maybe on the opposite end of the spectrum and prefer monthly and yearly planning. Regardless, the key is to create something that you know will help you to attain the financial goals that you have.

4. Eliminate impulse buying triggers once and for all

Mark Jewell cited a study in his article, which states that “people’s spending judgments are affected negatively when they are down, especially when they’re a bit self-absorbed”.5

Hello retail therapy!

Shopping increases dopamine, which behaves like a pleasure hormone in our body.

For many women shopping is the cure all to overcoming unpleasant emotions. We treat ourselves when we feel bad because it makes us feel good. Shopping increases dopamine, which behaves like a pleasure hormone in our body. It’s the same reaction as eating chocolate.

Giving yourself a reward for doing something good or making yourself feel better when you’re sad is healthy, but when it starts to control you it can be detrimental to your financial goals.

Help yourself by getting rid of any triggers that can cause you to impulse buy. Limit the amount of cash you bring with you. Leave your credit cards at home. I usually just have my pre-paid MasterCard so I know exactly how much I can and cannot spend.

And don’t forget to unsubscribe from newsletters. Turn off notifications for sales on your mobile. Better yet why not delete all those shopping apps. Do you really need them? Once your triggers are removed your impulse buying will get under control.

5. Cook your own meals and prepare your drinks at home

If you regularly eat out or like to grab that super fancy latte at your favorite Starbucks this can be a real challenge. It’s crazy how much money you can spend eating out per month.

Last year when I was doing my taxes, I almost fell off the chair at the amount of receipts I had for meals and coffees. Ouch!

Look you’ve got to get your finances under control and start saving some money. So, skip the take-out meals, dinning out, drive through coffees, etc. and start making your meals and drinks at home instead. For sure it will take a bit of planning and getting used to, but you won’t believe how much money you will be saving right from day one.

When I started this what really worked for me was to make my coffee time special at home. And ‘yes’ I did spend some money, but nowhere near what I was spending going out. Instead I bought my Starbucks coffee grounds in Walmart (vanilla my favorite) and then I would go to the baked goods and find something yummy. The amount I spent for the whole week is what I used to spend in one day.

Go a step further and place a mason jar beside your coffee pot. And when you go to have your coffee at home put in the money that you would normally spend going out. See how fast it fills up.

6. Learn the power of saying ‘no’

When we say that we can’t afford to go out for dinner with our friends it doesn’t necessarily mean that we literally do not have the money to go (it can mean that…been there done that), but in most cases it means that we have shifted our priorities. We are working towards our financial freedom and at this point in time have chosen to allocate our funds elsewhere. Be proud of yourself.

Accepting invitations from friends regularly (even though they mean well) can damage your efforts and jeopardize your goals. We all know it’s easier said than done, but it’s better than ending up with a failed month making it twice as hard to get caught up. A few hours of fun is not worth it. Believe me.

Saying ‘yes’ is easy but learning how to say ‘no’ is the challenge.

www.savingsblogger.com

Saying ‘yes’ is easy but learning how to say ‘no’ is the challenge. And it’s a challenge worth taking. The power of saying ‘no’ helps to build your self-discipline when it comes to temptation.

7. Make a plan to pay off your debts and stick to it

Debt comes in all shapes and sizes. From school loans, to credit cards, car loans, overdraft debt, and so on. At some point you needed something in your life that you did not have the money for at the time. Nothing wrong with that, but now it’s time to get those debts under control.

Why you need to pay off your debts:

- Opportunity Cost – your current income is essentially hijacked because all your expendable funds are going toward your debts. No money for fun 🙁

- Interest Cost – banks are in the business of making money from charging you interest. This means that the real cost of that TV or mobile phone you bought last month is much higher than the ticket price. You are giving away your hard-earned money. Double ouch!

- Freedom Cost – your financial security is at risk as your income is allocated elsewhere. This means that you are not able to save money towards an emergency fund, retirement, or even a holiday.

- Health Cost – there is a direct correlation between debt and health. Being in debt increases stress hormones, such as cortisol. Prolonged periods of cortisol in your blood can cause weight gain, heart disease, headaches, depression, anxiety just to name a few. Nuf said!

- Future Cost – a lot of debt, especially credit card debt can have an impact on your credit score. Imagine if you wanted to buy a house (yes getting into more debt) or you needed a credit check done to get an apartment. The point here being with a negative credit score your life choices can be limited.

Paying off your debts must become your top priority. Create a sense of urgency by pairing up your numbers with dates. How much do you need to pay by when? Make sure to include all of your debts in your budget.

If you’ve got tons of debt, start with the smallest amounts first. A study published in the Journal of Marketing Research reports that paying off your smallest debts first can help you gain the motivation you need to tackle the larger bills.6 Researchers concluded that completing small tasks provides an added boost to motivation, which helps people tackle larger tasks.

Closing thoughts

Get your spending under control so that you can start saving money and finally get rid of those debts that are holding you back from your financial goals. Start by identifying what you are buying and why. If it’s emotional identify the triggers. Cook your own meals and make your coffee at home. Stop accepting invitations to go out with friends if it is negatively impacting your finances.

Make paying off your debts a priority and understand the costs involved in carrying debt. Create a budget that works for you. Start tracking your expenses so that you know exactly where your money is going. And most importantly set goals that are motivating and keep you engaged.

Your financial freedom is important. Isn’t it time to have the life you really want?

If you found this blog post helpful, or if you know someone that is struggling with debt, please share it!

References:

- Science Says This One Money Habit Will Actually Change Your Life, Science Says This One Money Habit Will Actually Change Your Life, https://thriveglobal.com/stories/financial-habit/

- Making a Vision Board Could Help You Save Money, Being Sentimental Could Help You Save Money, https://www.thecut.com/2020/01/making-a-vision-board-could-help-you-save-money.html, Charlotte Cowles

- Chart: U.S. Household Debt Tops $14 Trillion for the First Time | Statista, https://www.statista.com/chart/19955/household-debt-balance-in-the-united-states/

- 6 Reasons Why You Need a Budget, 6 Reasons Why You Need a Budget, https://www.investopedia.com/financial-edge/1109/6-reasons-why-you-need-a-budget.aspx

- Study: Sadness can make you spend more – ABC News, Study: Sadness can make you spend more, https://abcnews.go.com/Business/story?id=4268597&page=1, ABC News

- The Psychological Trick That Will Help You Pay Off Debt Fast | Psychology Today, Psychology Today, https://www.psychologytoday.com/us/blog/what-mentally-strong-people-dont-do/201509/the-psychological-trick-will-help-you-pay-debt-fast